Trading fees at TOM

39 comments / November 25, 2011

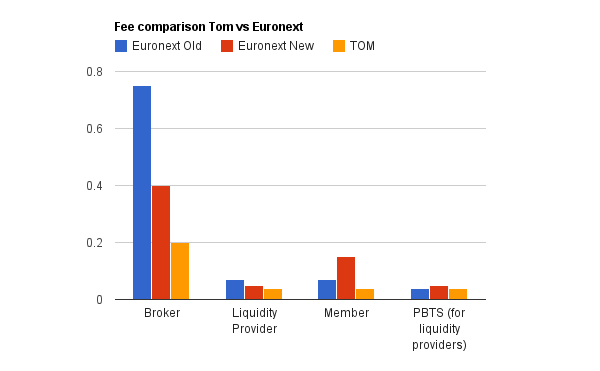

There it is. Tom announced their trading fees for market makers and retail flow. It’s cheaper in Sweden. But not that much. Note the market maker fees will probably be a little lower when acting as liquidity provider. The current rate for liquidity providers at Euronext is 5 cent. No information yet on the fees for Holland Clearing House.

Most eye catching are the free fall in prices charged to brokers. They have been paying outrageous prices for years. Question remains whether retail investors will benefit from this. They should. Lower broker fees will attract more financial institutions to connect. This is the main competitive battlefield.

A market without liquidity in terms of size and depth is useless. Therefore market makers will be lured by lower fees. All of ‘m will pay 4 cent per option, compared with 5 at Euronext. That’s not a sensational price cut, but it’s reasonable TOM will charge less to quoting liquidity providers. Hence the statement 4 cent is the maximum fee.

Euronext raised the price for non-quoting market makers, but TOM doesn’t see the point bullying the small ones. The Premium Based Tick Size fees used to be 4 cent and will be raised to 5 cent per December 1 (these are the cheap far out of the money options).

Maximum fees per order.

One more thing. Euronext raised the maximum fee for (prof) transactions to 200 euro in stock options and 500 euro for index options (and uncapped for index options traded through the screens). Up from 40 euro, that isn’t pocket money. TOM decided to set their maximum fee per order at 40 euro. They must have been pleasantly surprised by the new Euronext prices.

euh Jack, het is een beetje wazig

I thought I forgot my glasses this morning. But it is not me.

Ah click on the picture for less fog

Tiger blood

Option

Machine

winning!

But 20ct on TOM and 40ct on Liffe for retail is sure interesting…..

No it’s not … for example, BinckBank have made it clear that their fees will not go down. In the end, a BinckBank client will end up with “TOM options” instead of Euronext options, and there is no cost saving for the client. The winners here are TOM and BinckBank (co-owner of TOM) in case you hadn’t figured it out yet.

the winners are gonna be the retail-investors who eventually are going to pay less … not immediately no

@ 1:18pm … dan geloof je zeker ook in Sinterklaas? Alsof Optiver (een andere eigenaar van TOM) zich al die moeite getroost voor de transactiekosten van Piet Particulier?!?!

Of het nu 20 of 40 cent is, de broker vraagt een veelvoud, nu en in de toekomst. Er gaat dus weinig veranderen.

@ 1:44 pm … http://mijnbroker.nl/

€1,70 … en dat is pas het begin – mark my words!

all market parties are interested in market growth (esp from retail). Once price competition kicks in (other brokers may also connect and get lower TOM fees, or enjoy the increased price pressure at Liffe) and brokers lower their fees Binck is bound to follow. This won’t happen overnight of course, Binck made investments and has only started today, but one year later we’ll be seeing totally different rates for sure. Focus on increasing the pie please.

amen!

€ 1.70 … en die prijs hebben ze vandaag aangepast? Hoe het ook zij, mijn rekensommetje is dat de broker € 1.30 of meer opstrijkt versus € 0.40 voor Euronext. Dan helpt klagen over Euronext maar in beperkte mate, dat lijkt nog wel eens vergeten te worden. Particulieren gaan niet tweemaal zoveel handelen als de transactiekosten halveren (temeer daar ze minder vaak in- en uit handelen dan wij en bijgevolg niet al hun posities kunnen verdubbelen).

Overigens ligt het actuele tarief voor opties bij Binck op €2.90 (Euronext en TOM, na introductie). Ondanks dat mijnbroker 40% goedkoper is handelt 1/3e van de particulieren opties via Binck. Dat bewijst dat de particulier zich weinig bewust is van de kosten en reeds om die reden zijn geen majeure verschuivingen te veranderen.

VDM Online Trader was far cheeper and bedter!

Hmm. 19 lots traded on the first day.

@ 5.11pm Don’t be pessimistic, focus on increasing the pie!

A High freq firm gets slapped with a fine

http://www.chicagotribune.com/business/breaking/chi-cme-fines-infinium-850k-for-trading-glitches-20111125,0,5751614.story

en dan hebben we het nog niet gehad over de risk bij Tom 1 clearing 1 bank en optiver die alles mag hedgen met de zelfde bank

inderdaad. ik wil het niet opnemen voor euronext, maar de particuliere belegger is niet gebaat bij tom. kostenvoordeel nagenoeg nul (de broker steekt de lagere transactiekosten in z’n zak) en wat er allemaal achter de schermen gebeurt met zijn “tom”-opties i.pv. euronext-opties, alleen maar kans op ellende en complicaties.

de eerlijkheid gebiedt te zeggen dat als de bank in kwestie (abn amro clearing) om zou vallen, nogal wat mensen hier sowieso een probleem hebben (ook zonder tom).

i dont understand that all the options are nothing but gambling, i dont understand how industry dynamics would change eventually to retail’s favor once TOM is serious competitor, i think everything is rocket science since i care not to go in any sort of details of workings, i also dont understand that ABN was rescued by dutch govt and that no big govt in serious minds would let any banks fail, for christs sake even the puny irish bailed out all the savers and investors of AIB, Anglo and BKIR .. even though irish govt went bankrupt soon after .. this is democracy, silly people like me elect politicians who never let us go bankrupt for fear of loosing votes ..

TOM will be a serious competitor the day monkeys come flying out of my ass

old silly woman: you are confusing ABN Bank with its much smaller daughter ABN Clearing. The former is in the too-big-to-fail category, the latter is not.

So if much smaller daughter ABN Clearing goes bankrupt, the parent company would let it fail ?

So the question is how many monkeys are hiding up or your arse or alternatively why is TOM not likely to be serious contender, for the latter since there is no advantage to end user so they’ll prefer established exchange ?

9:45 am: Are you serious? Why wouldn’t they let it fail? Because you think ABN Bank (=Dutch taxpayer) feels a moral obligation to bail out HFTs and market makers? Get a clue!

lol, sorry i upset you a bit,

so there is no recourse to parent company if the daughter company fails?

and how would the daughter company end up failing, for lack of enough margining?

no recourse … they are separate legal entities

whether it is likely that such a large clearer would (could) go bankrupt, or how such an event could come about is more difficult to answer

thats what we also thought of MF global and lehman

and ABN parent would be happy to let retail suffer losses due to ABN daughter failing?

and if you can’t even come up with any sort of scenario of bankruptcy why was ABN Clearing going bankrupt mentioned in any case?

and now ABN Clearing is being compared to MF and Lehman ??!

I see that Interactive Brokers has lowered the Euronext fees by 35 cents to 1.65/contract. Go TOM!

Are the monkeys flying out of ass already?

By the dozens … you were referring to Euronext cost reductions being passed on to customers. In and out of itself TOM is not a success. For anyone to suggest an options exchange where fewer than 1,000 contracts have traded is a success is leaving in a dream world.

so this initial TOM trading volume is clearly reflective of future performance>? is that what you sell to investors, historical performance>?

I’m such a pasetic loser!

@ pikkie

you surely are, don’t even know how to spell *pathetic* right.

who is pikkie?

Retail investers are still screwed over.

It will take a lot more than 1 mijnbroker to change that.

Perfect competition means infinite buyers and sellers, most you get is duopoly or maybe oligopoly, so this is expected,

i would be subscribing to your feed myself in case you got more interesting posts next time.http://www.plasticasilicone.com